stock market bubble meaning

A stock market bubble is a significant run-up in stock prices without a corresponding increase in the value of the businesses they represent. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

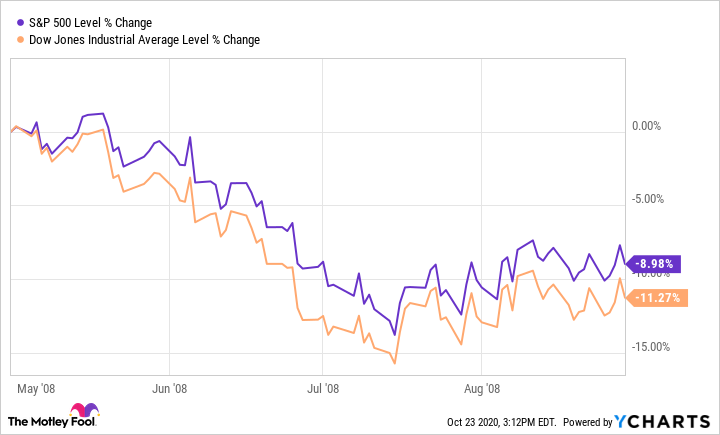

What Are Stock Market Corrections The Motley Fool

Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place.

. A bubble is defined as a. A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value. The rise in price takes the value of the stock above and beyond its intrinsic or true value.

Jeremy Grantham co-founder of hedge fund GMO is warning that stocks could fall a lot further. For investors on an individual level entering the market in the later stages of a bubble could mean painful losses. Grantham added that as bubbles form they give us a.

There is no specific technical definition for what constitutes a bubble in the stock market. The old saying goes you never know youre in a bubble until it bursts and that is especially true in the stock market. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behaviorBubbles occur not only in real-world markets with their inherent uncertainty and.

Once a bubble bursts a stock market crash often follows. Rather the term bubble is used to describe any situation in which emotional investing has inflated prices beyond the actual value of the underlying assets. A stock market bubble generally refers to a situation where the price of stocks far exceed their intrinsic or fundamental value.

A stock market bubble is a period of growth in stock prices followed by a fall. A stock market bubble occurs anytime the value of the stock market grows out of control. Stock market bubble is a term thats used when the market appears exceptionally overvalued driven by a combination of heightened enthusiasm unrealistic expectations and reckless speculation.

During a market bubble the valuations of many companies expand beyond what many investors would consider reasonable. Bubbles occur during economic cycles that result in substantial increases in the value of assets resulting in dramatic spikes in asset values. A market bubble is a rapid rise in the price of stocks or other assets that is not justified by fundamentals and is followed by a sharp fall in prices once investor enthusiasm wanes.

The term bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or even an entire sector market or asset class. An abrupt decrease in value resulting from this rapid inflation is called a crash or bubble burst and is sometimes seen as follows in an exchange rate jump. A stock market bubble also known as an asset or speculative bubble is a market movement consisting of a rapid exponential increase in share prices over a period of time.

What Does A Bubble Mean In The Stock Market. Stock market bubbles are notoriously difficult to spot but are famous for potentially causing large-scale consequences such as market crashes and recessions. Where have you heard about a stock market bubble.

A companys valuation should be. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a period. But misdiagnosing a stock market bubble or exiting from positions too.

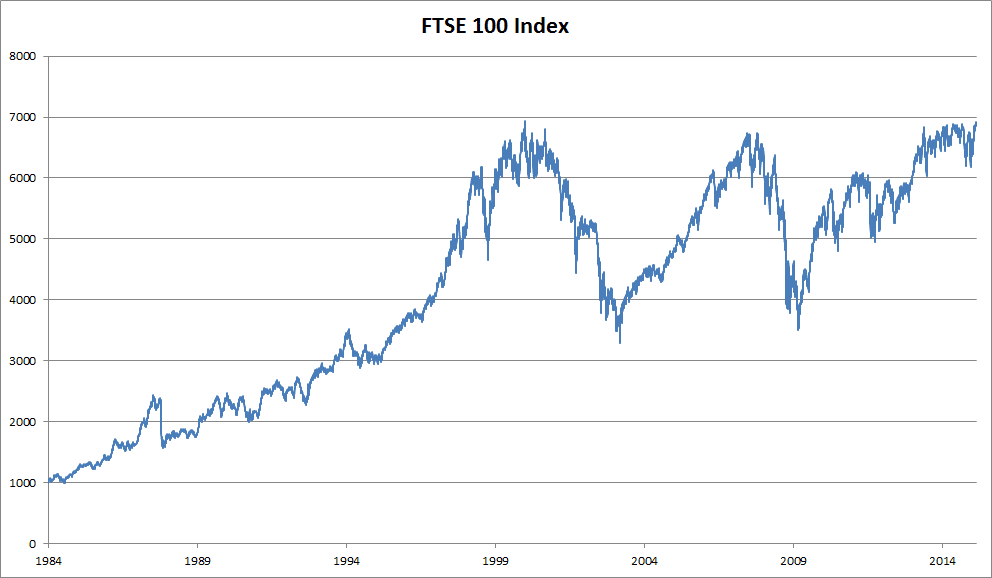

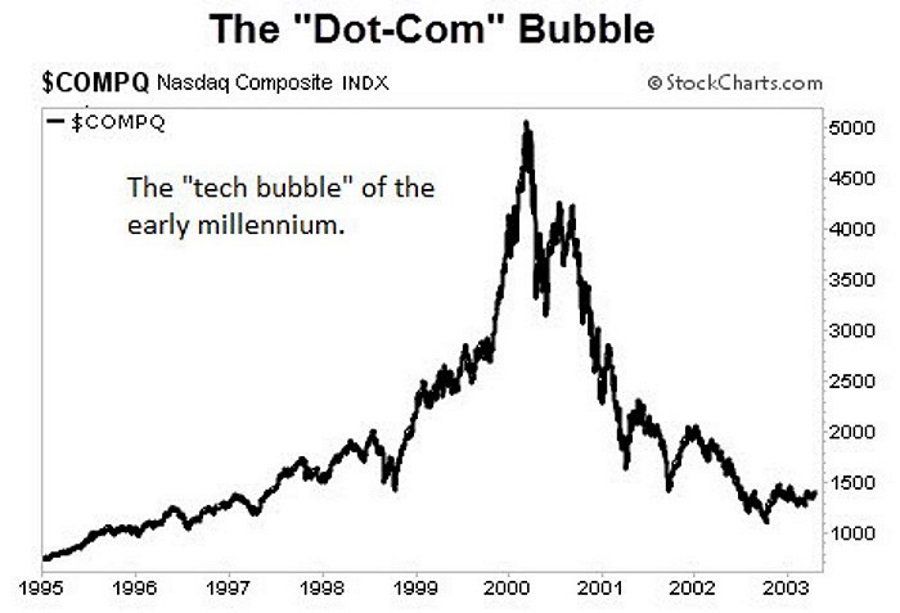

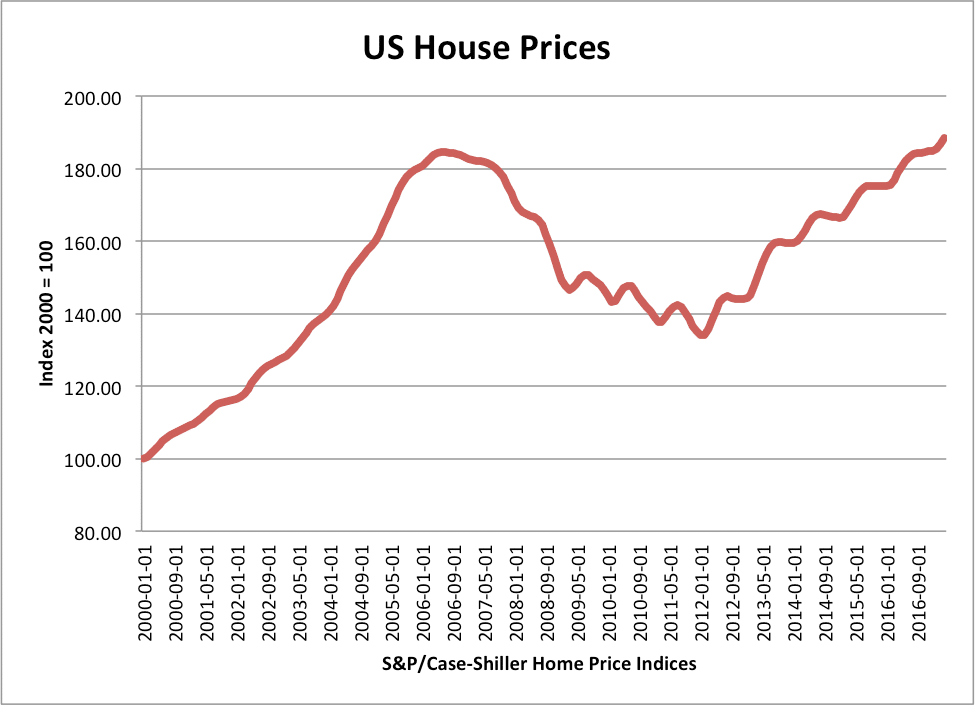

What Does A Bubble Mean In The Stock Market. The dot-com bubble and housing market bubble are. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

This situation is referred to as a bubble because it typically grows slowly over time as share prices and valuations rise. Bubble economics refers to the rapid increase of economic values usually the price of assets that occurs during such an economic cycle. After rapid inflation a quick decrease in value is experienced which depending on the type often refers to a bubble burst or a crash.

What Is An Economic Bubble Definition And Causes Market Business News

How Does The Stock Market Affect The Economy Economics Help

6 Black Swan Events That Rocked The Financial Markets Forex Training Group

What Is A Stock Market Crash Causes Consequences And How To Prepare

Stock Market Crash Definition Characteristics Finance Strategists

What Are Stock Market Corrections The Motley Fool

What Is A Stock Market Bubble Forbes Advisor

Economic Bubble Definition Types And 5 Stages Of Financial Bubbles Morethandigital

A Brief History Of Major Financial Bubbles Crises And Flash Crashes

What Is A Stock Market Crash Causes Consequences And How To Prepare

The Stock Market Bubble Starts To Burst Chemicals And The Economy

A Brief History Of Major Financial Bubbles Crises And Flash Crashes

What Are Stock Market Corrections The Motley Fool

Types And Causes Of Financial Bubbles Economics Help

Will The Stock Market Crash In 2022 Gold Avenue

This Graph Shows Why The Stock Market Is About To Fall Off A Cliff

/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)

/wall-street-crash-78075346-08e95275110a4afd80681699e5d72bcb.jpg)